I started Life Solutions by TQ with one purpose:

To transform the way people approach retirement and protection.

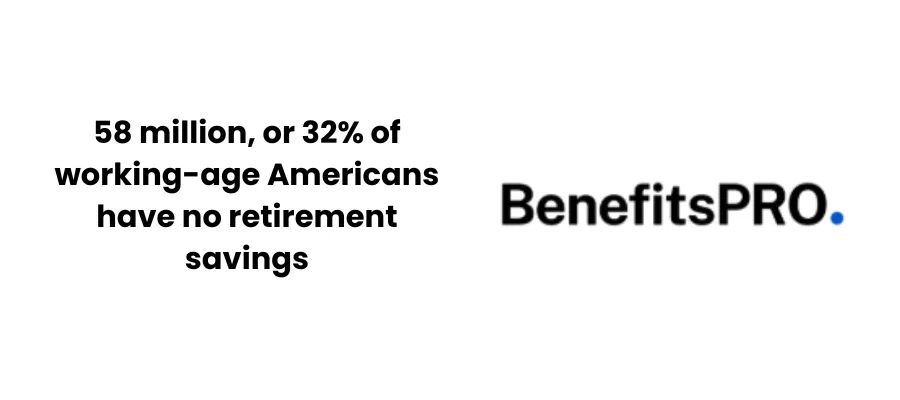

Too many hardworking individuals worry about losing their savings to a volatile market. Others don't realize that life insurance can actually support them while they’re alive. I’m here to change that.

With compassion, clarity, and customized planning, I help my clients:

Protect their retirement income from market loss

Design guaranteed lifetime income streams with fixed indexed annuities

Use life insurance with living benefits for real-life needs

Navigate life’s financial decisions with confidence and clarity

Whether you’re an individual, family, or small business owner - At Life Solutions by TQ, we believe peace of mind in retirement shouldn't be a luxury. It should be your reality. That's why we specialize in designing customized life and retirement solutions that help protect your future from life's uncertainties.

I started Life Solutions by TQ with one purpose:

To transform the way people approach retirement and protection.

Too many hardworking individuals worry about losing their savings to a volatile market. Others don't realize that life insurance can actually support them while they’re alive. I’m here to change that.

With compassion, clarity, and customized planning, I help my clients:

Protect their retirement income from market loss

Design guaranteed lifetime income streams with fixed indexed annuities

Use life insurance with living benefits for real-life needs

Navigate life’s financial decisions with confidence and clarity

Whether you’re an individual, family, or small business owner - At Life Solutions by TQ, we believe peace of mind in retirement shouldn't be a luxury. It should be your reality. That's why we specialize in designing customized life and retirement solutions that help protect your future from life's uncertainties.

Book Tracy to Speak

Topic: “Gambling with Your Future? Discover How to Retire with Confidence”

If you’re hosting a conference, luncheon, or educational workshop, I’d love to share what I’ve learned and inspire your audience to take control of their financial well-being. Use the form below to request availability and details.

Book Tracy to Speak

Topic: “Gambling with Your Future? Discover How to Retire with Confidence”

If you’re hosting a conference, luncheon, or educational workshop, I’d love to share what I’ve learned and inspire your audience to take control of their financial well-being. Use the form below to request availability and details.

Frequently Asked Questions

Life Insurance/ Living Benefits

What are Living Benefits?

Living Benefits allow you to access an insurance policy’s death benefit while you are still alive. Living Benefits can provide financial support to families and individuals when they are facing serious health challenges. The benefits can be associated with terminal, chronic or critical illnesses. It is important to note that certain circumstances must be present to qualify for living benefits and they are not suitable unless you also have a need for life insurance.

What can the living benefits money be used for?

You can use the money for any purpose, including medical and non-medical expenses, income replacement, compensation for non-licensed care providers, structural changes to a home to accommodate an illness or disability.

Can I qualify for living benefits if I have a pre-existing condition?

Whether or not you will qualify depends on the severity of the condition and diagnosis itself. Every person who applies for life insurance goes through a medical underwriting process, and your eligibility to qualify will be determined by your unique set of circumstances.

What if I can’t afford a permanent life insurance policy right now?

You have the option to start with a less expensive Term Life insurance policy and convert it to a permanent life insurance policy later in life.

How quickly can the living benefits be accessed if needed?

Once a qualifying condition is diagnosed and approved by the insurance company, the benefits can sometimes be accessed within a few weeks. Some of the benefits require a waiting period up of to 90 days from the date the policy is issued. It is also important to note that if the diagnosis occurs within the first 2 years of the policy being issued, the insurance company has the right to review the claim/policy.

How much is life insurance going to cost?

There are many factors that are used to determine the cost of life insurance. These include the type and amount of coverage needed, age, health, lifestyle, occupation and gender. It is important to note that the cost of insurance can be significantly impacted by your medical history and lifestyle choices (smoking, exercise, diet, driving record, risky hobbies).

Why would I need life insurance if I am young and healthy?

When you are young and healthy is the best time to get life insurance. It costs less, and if your health changes before you get insured, you may not qualify for life insurance when you get older.

Do I really need life insurance if I am single?

It deserves some serious consideration. Even if no one is dependent on you at this time in your life, you may want to purchase life insurance to cover your debts, taxes, and final expenses, like funeral arrangements, so the financial burden does not fall on your loved ones. If your future plans include a spouse and/or children, you can lock in lower premiums now while you're young and healthy. Premium rates will increase as you age, or if your health deteriorates.

Retirement Planning

I already have a financial advisor, why would I work with an insurance agent too?

The money you’ve invested with a financial advisor is often tied to the ups and downs of the stock market. A Fixed Indexed Annuity (FIA) can provide a strong foundation for your retirement plan by protecting part of your retirement savings from market volatility.

Think of it as creating two financial buckets:

One portion can stay invested for growth potential, and

Another portion goes into an FIA, where it’s shielded from market losses while still earning interest over time.

A Fixed Indexed Annuity can serve two important purposes:

Provide a legacy for the people you care about most, or

Turn into guaranteed lifetime income that you can count on, no matter how long you live.

By adding an annuity, you gain confidence and peace of mind, knowing a part of your retirement savings will always be there—no matter what the market does.

Can you help me even if I am already retired?

Yes. It’s never too late to take a fresh look at your financial plan. By moving a portion of your retirement savings into a Fixed Indexed Annuity (FIA), you can help protect your money from the ups and downs of the stock market.

Depending on the policy you choose, you may even have the option to start receiving income right away—giving you greater stability and confidence in your retirement.

Can you help me with a retirement plan from my previous employer?

Yes. If you have a retirement plan (401k, 403b, 457, TSP) from a previous employer, you are most likely still paying management fees to keep it there. It can be transferred to a fixed indexed annuity where your money can continue to grow and be safe from market loss. As your guide through this process, I can help you avoid costly mistakes and penalties when transferring funds between accounts; however, you should always get guidance from your CPA when it comes to anything related to taxes.

I don’t need or want life insurance, what can you do for me?

Whether you’ve been saving for retirement for years or are just getting started, I can help you explore financial strategies that offer protection from market volatility, the potential for growth, and the security of lifetime income. Unlike life insurance, these strategies don’t require medical underwriting.

What if other people are telling me that annuities are not a good thing?

Annuities have changed drastically over the years and people may be referring to the older style of annuity products because they are not aware of the new changes.

Annuity definition: a contract between you and an insurance company. You pay the company premiums, either over time or in one lump sum, and in return, the company provides you with a series of regular payments that can start immediately or at a future date. Annuities provide you with peace of mind that your money will be there when you need it most.

Fixed Indexed Annuities are a newer option in the annuity world, designed to offer both protection and growth potential. They give you peace of mind by helping shield your savings from significant market downturns - a benefit that can be especially important if you don't have the time or flexibility to recover from major losses.

What questions should I ask my financial professional, especially as I approach retirement?

a) Do you offer any products that can protect my savings from market losses?

b) How does it benefit me to keep my money at risk in the market now that I’m retired?

c) Do you offer annuities that provide lifetime income? If so, do they have management fees, and are they protected from market downturns?

d) What are your management fees, and are they deducted directly from my retirement funds?

e) “If there’s a way to keep my principal and earnings safe from market loss and have guaranteed income for life, wouldn’t it make sense to consider that strategy?”

What is a Fixed Indexed Annuity (FIA)?

A fixed indexed annuity provides you with the ability to grow your money (upside potential) without the risk of loss due to a market downturn (downside protection). Interest is credited to your policy based on the performance of market indices. This is accomplished using a “ceiling” and a “floor”. A ceiling is the maximum gain in interest you can earn (otherwise know as a “cap”), while a floor ensures that your principal is protected from losses, generally providing a minimum return of 0% interest.

Does it matter when I retire?

Yes. As you approach retirement, the five years before you retire and the five years after are critical—especially if your retirement savings are invested in the stock market. This 10-year period is known as the Retirement Risk Zone. If you incur financial losses from a market downturn in the five years before you retire, there may not be enough time to recover from those losses before your intended retirement date. The early stages of the Retirement Risk Zone play a crucial role in determining how long your retirement savings will last.

Are annuities only for older people who are getting ready to retire?

No. An annuity may be a good choice for your long-term goals, such as saving for retirement. You are never too young to plan for your future. If you think you may need to access these funds before you are 59 ½ years old, an annuity may not be the right savings vehicle for you. However, if you start contributing to an annuity while you are young and you use it as a long-term growth strategy, it can serve as a valuable part of your retirement planning portfolio as you get older.

How do life insurance agents who sell annuities get paid?

Life insurance agents get paid directly from an insurance company in the form of a commision, which is not deducted from your retirement funds.

Small Business

What is Key Person insurance?

Key Person insurance is a type of life insurance that a business takes out on a team member whose contribution is vital to the success of the company. The business owns the policy and pays the premiums. If the insured/key person passes away, the business receives the death benefit. This strategy helps ensure that the company can survive and continue operations if a vital team member unexpectedly dies.

What is an Executive Bonus Plan?

An Executive Bonus Plan is a strategy that can be used by a business owner to retain and reward their top employees, using a life insurance policy. The employee owns the policy, which includes any available cash value, their family is financially protected in case something happens, and the company pays the premiums as a “bonus” for the employee. Because the premium payments are considered a bonus, the premium payments are considered taxable income to the employee. This strategy may be more cost effective to the employer that setting up a full retirement plan. The employer has the discretion to choose who receives this benefit.

What is a buy-sell agreement? And how can it help protect my business?

A buy-sell agreement is an important tool used in business succession planning. When life insurance is used to fund a buy-sell agreement, it typically means that a life insurance policy is purchased on the lives of each owner. If one owner dies, the surviving owners receive the death benefit proceeds to purchase the deceased owner’s business interest. This legally binding contract lays the foundation for a smooth transfer of ownership. It prevents disruptions of business operations and guarantees that the deceased owner’s heirs or estate will receive a fair price for the business interest.

Do you offer retirement plans for my employees?

Yes. We can offer retirement plans for businesses with 1-100 employees and our policies satisfy mandatory state requirements. The annuities we provide have no third-party administrators, which means that there are no administration fees or asset management fees. Matching options are available but not required and the employers may be eligible to receive tax credits for start-up costs and contributions. Important note: You should always get guidance from your CPA when it comes to anything related to taxes.

Can your insurance plans help with capital expenses?

Yes. As a small business owner, you have access to the cash value accumulated in a permanent life insurance policy. Cash value can be accessed through policy loans or withdrawals. The cash value can be used to fund business needs such as, working capital, seed money to start a new venture, acquisitions and expansion. Always consult with your tax advisor to fully understand the tax implications of accessing or surrendering the cash value.

Do you offer life insurance protection?

Yes. We offer individual term and permanent life insurance policies for both you and your employees. These policies include Living Benefits, which allow the insured person to access an insurance policy’s death benefit while they are still alive. Living Benefits can provide financial support to families and individuals when they are facing serious health challenges. The benefits can be associated with terminal, chronic or critical illnesses. It is important to note that certain circumstances must be present to qualify for living benefits and they are not suitable unless you also have a need for life insurance.

I don’t have any employees. Can you help me if I am a solopreneur?

Yes. As a Solopreneur, you most likely do not have access to a company retirement plan like a 401k. A SEP (Simplified Employee Pension) IRA annuity plan is designed for self-employed individuals and small business owners. Advantages to this type of plan include higher contribution limits, tax-deferred growth, tax-deductible contributions and the flexibility to change the amount you contribute each year. You should always get guidance from your CPA when it comes to anything related to taxes.

Can you help with my current personal retirement accounts?

Yes. If you have a 401k (403b, 457, TSP, IRA) from a previous employer, you are most likely still paying management fees to keep it there. It can be transferred to a fixed indexed annuity where your money can continue to grow and be safe from market loss. As your guide through this process, I can help you avoid costly mistakes and penalties when transferring funds between accounts; however, you should always get guidance from your CPA when it comes to anything related to taxes.

Frequently Asked Questions

Life Insurance/ Living Benefits

What are Living Benefits?

Living Benefits allow you to access an insurance policy’s death benefit while you are still alive. Living Benefits can provide financial support to families and individuals when they are facing serious health challenges. The benefits can be associated with terminal, chronic or critical illnesses. It is important to note that certain circumstances must be present to qualify for living benefits and they are not suitable unless you also have a need for life insurance.

What can the living benefits money be used for?

You can use the money for any purpose, including medical and non-medical expenses, income replacement, compensation for non-licensed care providers, structural changes to a home to accommodate an illness or disability.

Can I qualify for living benefits if I have a pre-existing condition?

Whether or not you will qualify depends on the severity of the condition and diagnosis itself. Every person who applies for life insurance goes through a medical underwriting process, and your eligibility to qualify will be determined by your unique set of circumstances.

What if I can’t afford a permanent life insurance policy right now?

You have the option to start with a less expensive Term Life insurance policy and convert it to a permanent life insurance policy later in life.

How quickly can the living benefits be accessed if needed?

Once a qualifying condition is diagnosed and approved by the insurance company, the benefits can sometimes be accessed within a few weeks. Some of the benefits require a waiting period up of to 90 days from the date the policy is issued. It is also important to note that if the diagnosis occurs within the first 2 years of the policy being issued, the insurance company has the right to review the claim/policy.

How much is life insurance going to cost?

There are many factors that are used to determine the cost of life insurance. These include the type and amount of coverage needed, age, health, lifestyle, occupation and gender. It is important to note that the cost of insurance can be significantly impacted by your medical history and lifestyle choices (smoking, exercise, diet, driving record, risky hobbies).

Why would I need life insurance if I am young and healthy?

When you are young and healthy is the best time to get life insurance. It costs less, and if your health changes before you get insured, you may not qualify for life insurance when you get older.

Do I really need life insurance if I am single?

It deserves some serious consideration. Even if no one is dependent on you at this time in your life, you may want to purchase life insurance to cover your debts, taxes, and final expenses, like funeral arrangements, so the financial burden does not fall on your loved ones. If your future plans include a spouse and/or children, you can lock in lower premiums now while you're young and healthy. Premium rates will increase as you age, or if your health deteriorates.

Retirement Planning

I already have a financial advisor, why would I work with an insurance agent too?

The money you’ve invested with a financial advisor is often tied to the ups and downs of the stock market. A Fixed Indexed Annuity (FIA) can provide a strong foundation for your retirement plan by protecting part of your retirement savings from market volatility.

Think of it as creating two financial buckets:

One portion can stay invested for growth potential, and

Another portion goes into an FIA, where it’s shielded from market losses while still earning interest over time.

A Fixed Indexed Annuity can serve two important purposes:

Provide a legacy for the people you care about most, or

Turn into guaranteed lifetime income that you can count on, no matter how long you live.

By adding an annuity, you gain confidence and peace of mind, knowing a part of your retirement savings will always be there—no matter what the market does.

Can you help me even if I am already retired?

Yes. It’s never too late to take a fresh look at your financial plan. By moving a portion of your retirement savings into a Fixed Indexed Annuity (FIA), you can help protect your money from the ups and downs of the stock market.

Depending on the policy you choose, you may even have the option to start receiving income right away—giving you greater stability and confidence in your retirement.

Can you help me with a retirement plan from my previous employer?

Yes. If you have a retirement plan (401k, 403b, 457, TSP) from a previous employer, you are most likely still paying management fees to keep it there. It can be transferred to a fixed indexed annuity where your money can continue to grow and be safe from market loss. As your guide through this process, I can help you avoid costly mistakes and penalties when transferring funds between accounts; however, you should always get guidance from your CPA when it comes to anything related to taxes.

I don’t need or want life insurance, what can you do for me?

Whether you’ve been saving for retirement for years or are just getting started, I can help you explore financial strategies that offer protection from market volatility, the potential for growth, and the security of lifetime income. Unlike life insurance, these strategies don’t require medical underwriting.

What if other people are telling me that annuities are not a good thing?

Annuities have changed drastically over the years and people may be referring to the older style of annuity products because they are not aware of the new changes.

Annuity definition: a contract between you and an insurance company. You pay the company premiums, either over time or in one lump sum, and in return, the company provides you with a series of regular payments that can start immediately or at a future date. Annuities provide you with peace of mind that your money will be there when you need it most.

Fixed Indexed Annuities are a newer option in the annuity world, designed to offer both protection and growth potential. They give you peace of mind by helping shield your savings from significant market downturns - a benefit that can be especially important if you don't have the time or flexibility to recover from major losses.

What questions should I ask my financial professional, especially as I approach retirement?

a) Do you offer any products that can protect my savings from market losses?

b) How does it benefit me to keep my money at risk in the market now that I’m retired?

c) Do you offer annuities that provide lifetime income? If so, do they have management fees, and are they protected from market downturns?

d) What are your management fees, and are they deducted directly from my retirement funds?

e) “If there’s a way to keep my principal and earnings safe from market loss and have guaranteed income for life, wouldn’t it make sense to consider that strategy?”

What is a Fixed Indexed Annuity (FIA)?

A fixed indexed annuity provides you with the ability to grow your money (upside potential) without the risk of loss due to a market downturn (downside protection). Interest is credited to your policy based on the performance of market indices. This is accomplished using a “ceiling” and a “floor”. A ceiling is the maximum gain in interest you can earn (otherwise know as a “cap”), while a floor ensures that your principal is protected from losses, generally providing a minimum return of 0% interest.

Does it matter when I retire?

Yes. As you approach retirement, the five years before you retire and the five years after are critical—especially if your retirement savings are invested in the stock market. This 10-year period is known as the Retirement Risk Zone. If you incur financial losses from a market downturn in the five years before you retire, there may not be enough time to recover from those losses before your intended retirement date. The early stages of the Retirement Risk Zone play a crucial role in determining how long your retirement savings will last.

Are annuities only for older people who are getting ready to retire?

No. An annuity may be a good choice for your long-term goals, such as saving for retirement. You are never too young to plan for your future. If you think you may need to access these funds before you are 59 ½ years old, an annuity may not be the right savings vehicle for you. However, if you start contributing to an annuity while you are young and you use it as a long-term growth strategy, it can serve as a valuable part of your retirement planning portfolio as you get older.

How do life insurance agents who sell annuities get paid?

Life insurance agents get paid directly from an insurance company in the form of a commision, which is not deducted from your retirement funds.

Small Business

What is Key Person insurance?

Key Person insurance is a type of life insurance that a business takes out on a team member whose contribution is vital to the success of the company. The business owns the policy and pays the premiums. If the insured/key person passes away, the business receives the death benefit. This strategy helps ensure that the company can survive and continue operations if a vital team member unexpectedly dies.

What is an Executive Bonus Plan?

An Executive Bonus Plan is a strategy that can be used by a business owner to retain and reward their top employees, using a life insurance policy. The employee owns the policy, which includes any available cash value, their family is financially protected in case something happens, and the company pays the premiums as a “bonus” for the employee. Because the premium payments are considered a bonus, the premium payments are considered taxable income to the employee. This strategy may be more cost effective to the employer that setting up a full retirement plan. The employer has the discretion to choose who receives this benefit.

What is a buy-sell agreement? And how can it help protect my business?

A buy-sell agreement is an important tool used in business succession planning. When life insurance is used to fund a buy-sell agreement, it typically means that a life insurance policy is purchased on the lives of each owner. If one owner dies, the surviving owners receive the death benefit proceeds to purchase the deceased owner’s business interest. This legally binding contract lays the foundation for a smooth transfer of ownership. It prevents disruptions of business operations and guarantees that the deceased owner’s heirs or estate will receive a fair price for the business interest.

Do you offer retirement plans for my employees?

Yes. We can offer retirement plans for businesses with 1-100 employees and our policies satisfy mandatory state requirements. The annuities we provide have no third-party administrators, which means that there are no administration fees or asset management fees. Matching options are available but not required and the employers may be eligible to receive tax credits for start-up costs and contributions. Important note: You should always get guidance from your CPA when it comes to anything related to taxes.

Can your insurance plans help with capital expenses?

Yes. As a small business owner, you have access to the cash value accumulated in a permanent life insurance policy. Cash value can be accessed through policy loans or withdrawals. The cash value can be used to fund business needs such as, working capital, seed money to start a new venture, acquisitions and expansion. Always consult with your tax advisor to fully understand the tax implications of accessing or surrendering the cash value.

Do you offer life insurance protection?

Yes. We offer individual term and permanent life insurance policies for both you and your employees. These policies include Living Benefits, which allow the insured person to access an insurance policy’s death benefit while they are still alive. Living Benefits can provide financial support to families and individuals when they are facing serious health challenges. The benefits can be associated with terminal, chronic or critical illnesses. It is important to note that certain circumstances must be present to qualify for living benefits and they are not suitable unless you also have a need for life insurance.

I don’t have any employees. Can you help me if I am a solopreneur?

Yes. As a Solopreneur, you most likely do not have access to a company retirement plan like a 401k. A SEP (Simplified Employee Pension) IRA annuity plan is designed for self-employed individuals and small business owners. Advantages to this type of plan include higher contribution limits, tax-deferred growth, tax-deductible contributions and the flexibility to change the amount you contribute each year. You should always get guidance from your CPA when it comes to anything related to taxes.

Can you help with my current personal retirement accounts?

Yes. If you have a 401k (403b, 457, TSP, IRA) from a previous employer, you are most likely still paying management fees to keep it there. It can be transferred to a fixed indexed annuity where your money can continue to grow and be safe from market loss. As your guide through this process, I can help you avoid costly mistakes and penalties when transferring funds between accounts; however, you should always get guidance from your CPA when it comes to anything related to taxes.